Building credit is an essential pillar of a successful financial life. Those who have good credit ratings are better able to take on debt, pay lower rates of interest, and more likely to receive capital for leveraged investment projects. Good credit enables people to grow their wealth faster and live the lives they want to lead.

Unfortunately, even those with stable jobs can sometimes struggle to maintain healthy credit scores. Money mistakes combined with basic financial illiteracy both contribute to the problem.

But why should bosses care? The main reason is that personal financial issues can roll over and affect work. Employees who are struggling to take out a mortgage or pay back debts may not be as effective in their roles.

As a business owner, it’s in your best interest to teach your team about building credit, and have financial planning for employees. The more you can communicate about the importance of financial health, the more productive they will be.

Teach them about Finances

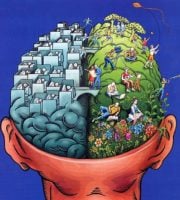

So what does financial literacy actually look like? Essentially, it is understanding basic elements of personal finance and how they all work together.

Experts typically break up financial literacy into four distinct categories or topic areas:

- Budgeting

- Banking

- Debt management

- Credit building

Budgeting encompasses everything involved in ensuring that employees live within their means. At a basic level, it ensures that expenses are lower than income month-to-month. However, it’s also about financial planning. When team members budget, it gives them an opportunity to figure out how they would like their financial lives to play out in years to come.

Smart banking is about using banking services sensibly, and in the employee’s best interest. Things to avoid are high overdraft charges and keeping large sums of money in low interest current accounts.

Debt management concerns how to repay debt once incurred. Employees will often need to learn both financial and psychological strategies to pay off their debts faster.

And, lastly, teaching people about finances also requires an education in credit building. Employees need to understand why it is valuable and how it can help them build greater wealth in the future.

Enlist help from financial seminar businesses to do workshops

Teaching your colleagues about the value of building credit is a noble pursuit. However, most business leaders simply do not have the time to dedicate to it. They have other concerns they need to address.

As such, many are turning to third-party training organizations. These provide team members with opportunities to engage with financial experts at a workshop and really understand the financial issues that they place.

Financial literacy is becoming increasingly problematic for employees. Despite growing economic productivity, 80 percent of employees say that they are facing increasing financial challenges. Personal money worries damage employee morale and put the brakes on creativity.

Third-party training attempts to resolve this by handing control back to employees. They learn how to better manage their finances, which tools they can use and why it is so important. Programs cover everything, from debt consolidation to how to take advantage of 401k’s fully.